Products and API solutions

Payment technology for borderless finance

Whether you seek off-the-shelf payment products for your financial and operational needs or aim to scale your business with embedded finance using our infrastructure, Reap offers the tools to fulfil all your financial ambitions.

Payment products

Our core products that streamline your financial operations: corporate credit cards, payouts, expense management.

Reap Card

A corporate credit card with flexible bill repayment available: in fiat or digital currencies.

Reap Pay

Pay anyone, anywhere using your preferred currencies: fiat or digital.

API solutions

Your dream payment solutions, tailored to your needs. Your vision, our infrastructure: card issuing, payouts.

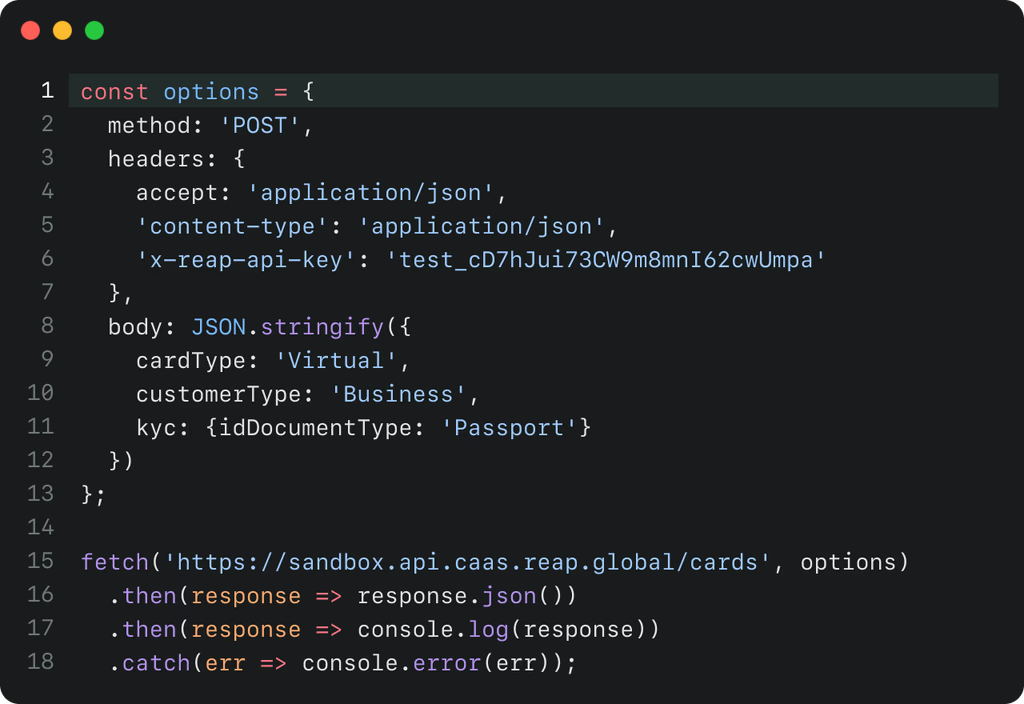

Card Issuing

Launch your own card program with our plug-and-play package.

Pay API

Advance cross-border payouts with international payment rails.

Reap’s technical infrastructure is competently built so that our IT team can integrate without any hassle. The management team at Reap is always in touch and ready to help with any problems that we are facing in using their Reap product. At Reap, we are treated as partners, not as clients.

Maksym Sakharov

CEO of Exflow

Our partners

Security

How we keep your funds secure

PCI compliant

We protect your data in compliance with the PCI DSS, and also enable you to create PCI DSS compliant solutions.

Licensed and regulated

With an MSO license in Hong Kong, we are your trusted partner for international payouts.

Fraud prevention

Using sophisticated transaction monitoring tools such as Chainalysis, we uphold the highest anti-fraud standards to safeguard your transactions.

Developers

Developer-friendly APIs

Secure sandbox testing

Robust API documentation

Rapid deployment

Dedicated support

As seen on