Reap Card

The corporate card for your global teams

Get a corporate credit card with no bank account or other complex requirements. Enjoy flexible settlement options in fiat or digital currencies, global coverage, advanced spend control, and a card designed to adapt to your unique needs.

Easy access

A corporate card for every business: don’t let your company size or industry hold you back

Credit information

USD 140,000 Credit Limit

$19,067 Spent

$120,933 Available

Available balance

$120,933

Spend control

Take full charge of your business spend

Stay ahead of expenses and control every type of spend, at any level.

Set predefined budgets on a daily, monthly or yearly basis

Travel allowance card

Monthly subscription fee cards

Yearly office supply cards

Customise budgets based on projects, individual roles, or specific time periods

Set up one-time or recurring budgets allowing you to allocate resources precisely.

Christmas party budget

Project-based campaign budget

Manage spend amounts, time, location, merchants, categories and more at every purchase point

Add restrictions to ensure spend is in accordance with company policy.

Create new budget

Budget title

Dubai expo trip

Budget amount

$

2,500.00

USD

USD 25,000 available from Main budget

Budget category

Meals and Entertainment

Budget owner(s)

Kristin Watson

Add user

Can create and modify cards for everyone in this budget. Read more

Cancel

Create new budget

Expense management

Master your spending with intelligent expense management

Scale globally

Designed for global teams of any size

Global coverage

Built on Visa's worldwide network, our solution allows employees to seamlessly clear local expenses with a globally accepted card. Experience effortless financial management across borders.

Scale without restrictions: unlimited cards issuable

Fuel your expansion with our unlimited card issuance and flexible credit limits. Scale your operations without constraints and experience unrestricted growth and financial flexibility.

Fiat and digital currencies accepted

Settle bills with fiat or digital currencies, anytime, anywhere

Make a Repayment

Outstanding balance

USD 2,458.90

Minimum payment

USD 300.00

Select payment method

Bank transfer

Debit the amount from your bank account directly

Reap stablecoins collateral

Use funds from the stablecoins you have collateralised with Reap

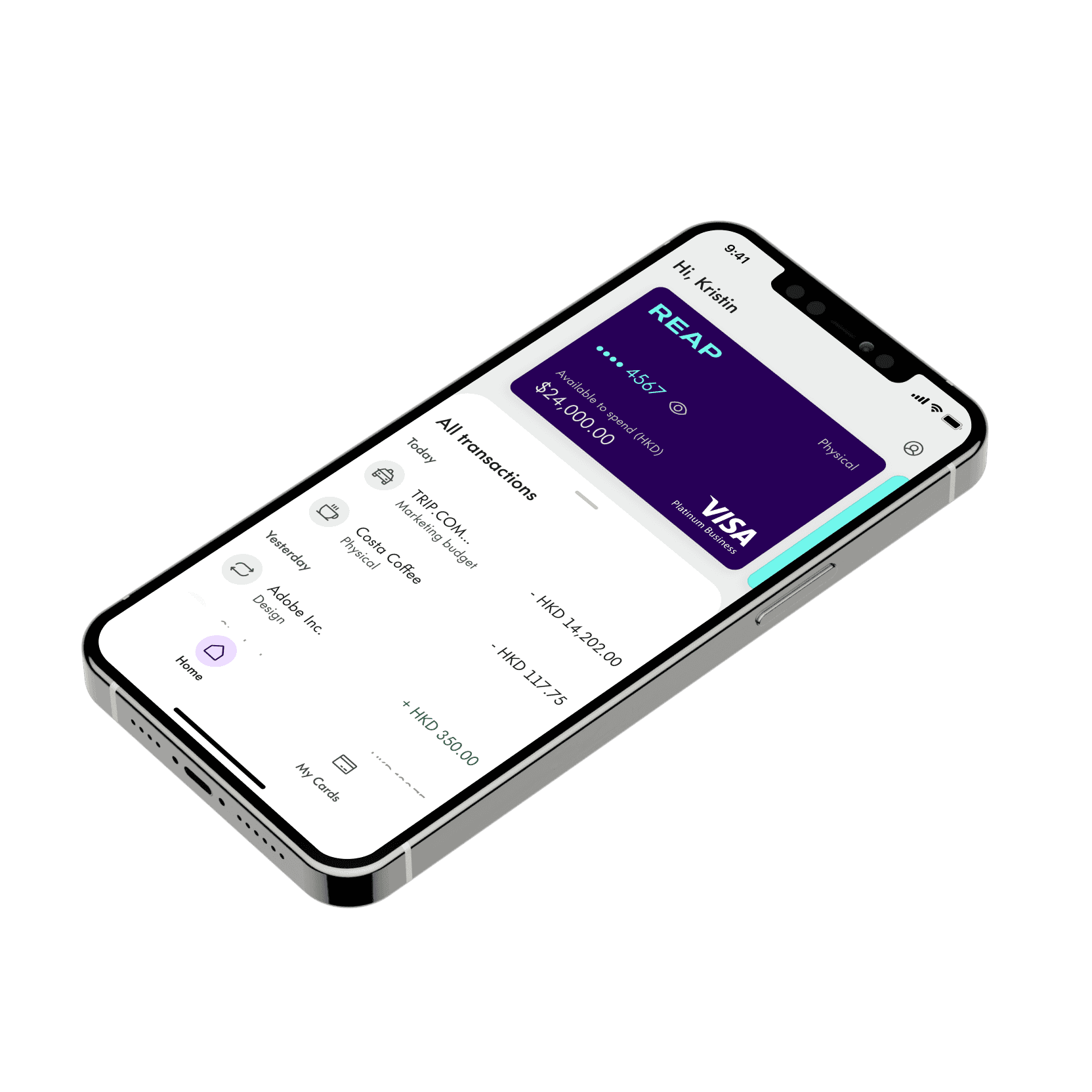

Mobile features

Beyond a traditional corporate card

Contactless payments at your fingertips

Leave the bulky wallets behind. Our mobile payment integration with Google Pay and Apple pay empowers you to make secure transactions using just your phone.

Track your company spend on the go with our mobile app

Monitor your company spend, upload receipts, freeze your card, all on the go.

Withdraw cash from an ATM using your corporate cards

Your merchant doesn’t accept cards? No problem. With the Reap Card, you can conveniently withdraw cash from the nearest ATM, ensuring you never miss payments.